A notice of intercepted funds is a letter informing you that an agency of, or the state or federal government itself, intend to withhold all or a portion of your tax refund due to debts owed. Refunds can be intercepted only under these circumstances:

A notice of intercepted funds is a letter informing you that an agency of, or the state or federal government itself, intend to withhold all or a portion of your tax refund due to debts owed. Refunds can be intercepted only under these circumstances:

– Delinquent taxes, state and federal level;

– Student loan defaults, at the federal level;

– If you are behind on child support payments, state and federal level;

– If you owe traffic or court fines, at the state level.

Other offices, such as construction companies, hospitals, other private or publicly-owned businesses, or individuals do not have the right to file a claim against your state or federal tax refund.

The applicable tax office must inform you, in writing, of the amount and reason for the proposed interception, including all details of the amount owed and the agency requesting your refund. However, many people don’t receive such notice until after the interception of funds has taken place and are not aware of their rights in such a situation.

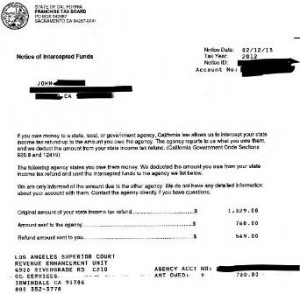

The letter will state the original amount of your state income tax refund. Then, it will state the amount sent to the agency and the remaining balance finally shows as the refund amount sent to you.

Typically, the process goes as follows:

1. An agency, such as the Department of Education or traffic court in the jurisdiction of the offense, will notify you of a delinquency or fine. They will also detail the remedies they will seek if the alleged debt is not satisfied, including the possibility of an interception of your tax refund. This is usually the last resort in an attempt to collect traffic fines or other debts owed by citizens to government agencies.

2. The agency will then notify the IRS or your state’s Department of Taxation and request a partial or full offset of your tax refund to in order to satisfy that debt.

3. The tax agency sends a letter notifying you of the claim against you, as well as information regarding the agency filing the claim, and the amount of the debt.

4. If there is a balance left after the interception, the tax office will issue you a refund for the remaining amount.

You can appeal an interception if you can prove that you don’t owe the debt, if the amount of the debt is in dispute, or if the debt has already been settled.

If you’ve received a notice of intercepted funds and you want to speak to a qualified traffic ticket attorney, contact our office today. Our lawyers can advise you of your rights and the remedies available to you.

Scott Desind

Latest posts by Scott Desind (see all)

- How to Request the County Seat and Fight Your California Traffic Ticket - May 21, 2023

- Don’t Even Touch That Cell Phone - July 13, 2022

- Innocent Until Proven Guilty - March 2, 2020